#78 - How to Win in the Next Iteration of SME Payments

Despite productivity challenges, SME's will continue to be critical to African Economies. The next wave is about using payments to power value added services. A handbook for the industry.

Illustrated by Mary Mogoi

Hi all - This is the 78th edition of Frontier Fintech. A big thanks to my regular readers and subscribers. To those who are yet to subscribe, hit the subscribe button below and share with your colleagues and friends. Support Frontier Fintech by becoming a paid subscriber🚀

For group discounts, write to me at samora@frontierfintech.io. If you can’t afford a subscription, consider referring a friend. The more you refer the longer your complimentary subscription is.

Reach out at samora@frontierfintech.io for sponsorships, partner pieces and advisory work. Spaces are becoming limited on my advisory hours. I help clients with market entry, market mapping, strategic insights, sounding board to founders and general advisory across Pan-African Fintech.

Sponsored by Paymentology

The Digital Banking Revolution—Are You Ready? Digital banks are growing fast, with TymeBank recently becoming a unicorn, proving the value they bring to customers. Their success is underpinned by world-class technology that powers seamless, innovative experiences. For banks looking to digitise, card management should be a top priority. The challenge is finding a partner who has done it before and share your mindset.

Paymentology has worked with leading digital banks like Mox, GoTyme, M-Pesa, Wio and others across 60+ countries. Their global expertise ensures banks (traditional and neo-banks) can build modern, scalable card programs that meet the expectations of today’s digital-first customers. This extends to your international strategy as Paymentology abstracts the complexity of going global through their infrastructure and partnerships. As a trusted partner in digitisation, Paymentology helps banks transform their card offerings into Digital First products.

Read about how Paycentral Leveraged Paymentology’s Infrastructure to Power its Payments Business

Introduction

The reports of my death are greatly exaggerated - Mark Twain

I’m a firm believer in the African SME story and its future potential. I think more and more SME’s will be formed and this will be the fastest growing vector in Fintech. My view is that SME Payments and particularly unifying SME payments will be a critical wedge to the broader SME enablement play. Nonetheless not everyone agrees with this view. At the beginning of the year, the Economist published an article called “Too Many Businesses, Too Little Business”. The premise of the article was that Africa has a significant productivity issue that ensures that large businesses are not being formed at the same rate as in other regions. The outcome is that we have too many SMEs that are actually masking unemployment figures. The graph below was used to show how Africa is not creating new large businesses vis-a-vis other regions. The graph shows that there’s a net-drop off in the number of billion dollar companies in Africa vis-a-vis other markets.

The core challenges cited were capital and electricity with the infamous US$ 5.2 trillion funding gap rearing its head again. Across social media and particularly LinkedIn, Africa’s intelligentsia quoted the article with their own takes. Resoundingly, it was as if the Economist has unearthed a major insight that we’ve all been getting wrong.

In my view, the hype to insight ratio from this article was off-the charts. These insights have been around for decades. Ory in an article on Quartz over a decade ago talked about how “We can’t Entrepreneur our way out of poverty”. Her argument was that we’re fetishizing entrepreneurship as a Panacea for Africa’s ills. Deeper productivity and governance issues still remain. A recent Moniepoint Informal Economy Report similarly cited unemployment as the biggest cause for entrepreneurship. These findings were similar to a MSME Survey done by the Kenya National Bureau of Statistics in 2016. All point to a massive long-tail of Micro SMEs that grapple with productivity and mask unemployment. Moreover, smart people in the continent know that there are major barriers to growth that are tied to leadership, the political economy and broader trade practices. That SME productivity is an issue is not in doubt.

The article nonetheless misses a critical nuance that would make it a more balanced take. In 1990, The International Institute for Labour Studies released a report called the Re-Emergence of Small Enterprises. The central idea was that across all major economies, there was a trend in key markers such as output and share of employment away from large enterprises and towards smaller enterprises. This finding was corroborated in a HBR study called Can Small Businesses Help Countries Compete?. This was published in 1990. The HBR article also noted a trend in share of production and employment moving away from larger enterprises to smaller enterprises. The core insight in the article was that it’s not about size but largely it’s about organisation. From the article;

But technological and economic developments are making possible a new kind of organization that combines the virtues of both. In this new organizational model, it’s not the size of a company that matters so much as the quality of the business relationships tying companies to each other. The key unit of production is no longer the individual company but a decentralized network of companies. Sometimes, these networks consist of vertical links tying small suppliers to large final assemblers. In other cases, the links are horizontal—binding together a number of more or less equal small companies. In both cases, these networks make possible continual innovation through a delicate balance of competition and cooperation, demands and support.

These observations in the 80s and 90s led to governments instituting more SME friendly policies and shifting focus from job creation to enterprise formation. The key factors that were driving increasing SME-fication across the world were;

Globalisation - Smaller firms increasing accessed global supply chains enabling them to be more productive and profitable;

Technology - The internet, improved communication and e-commerce enabled small companies to access tools that previously were only accessible to large firms. This is currently being accelerated by AI, social media and cloud computing;

Pro Enterprise Policy - Governments across the world are making it easier to register a business. This is being augmented by Digital Public Infrastructure across the world that helps in credit scoring, asset registration, digital payments and other services that empower SMEs;

Cultural Shifts - Young people across the world are seeing themselves more as entrepreneurs and less as career-men;

Too many small businesses is increasingly a global phenomenon and not just specific to Africa. The aim shouldn’t be solely to aim for a larger share of big businesses, but to increase the probability of success for the smaller enterprises. The article duly noted that capital is a big issue. Financial services companies in Africa should have this nuance in mind. Whilst there may be a productivity issue, how can we enable small businesses to thrive? This is the core thesis behind M-Kopa, Watu Credit, Capitec and Moniepoint. You can’t talk about SME’s in Africa without looking at global trends in SME formation. African markets will continue to struggle with productivity amongst both large and small enterprises. Nonetheless, the SME sector will continue to grow as it rhymes with the global trends driving small business formation.

This article will discuss how SME payments provide a wedge into providing the tools that enable SME productivity. The focus will be on Urban SMEs that have embraced digital payment tools and are aiming for growth. I argue that Fintech 1.0 which was useful for digital enablement has run its course, the next wave of Fintech and particular payments, will be more about data and insights that can be turned into higher value services that enhance SME productivity.

The African SME Context

Most people believe the media is biased. Anyone who doesn’t see this is paying scant attention to reality, and those who fight reality lose. Reality is an undefeated champion” - Jeff Bezos

The quote above is from an Op-Ed that Jeff Bezos penned in the Washington Post back in October 2024. The point is not that The Economist is biased, although an argument can be made here. The point is that analysing the SME space in Africa must be based on reality. Bezos’s call for realism applies to Africa’s SMEs. We must focus on what works, like technology-driven solutions, not media narratives.

Analysing the continent requires appreciating that it’s part of the world. It’s the same way the older generations talk of Manufacturing, specifically how Africa had a relatively strong manufacturing base post-independence that no longer exists. This debate can’t be genuinely had without looking at global trends in manufacturing. Manufacturing declined in the whole world and not just in Africa due to the China story. Looking at Africa as a unique entity that is not a part of a wider ecosystem misses the point.

That being said, the SME story is complex. The story of too many businesses is true. It’s also true that there are many SME’s in Africa that are developing both in services, trade and manufacturing that are solid sustainable businesses. These small businesses will continue to capture a larger share of the economy from both employment and total output. These small businesses are being powered by tech and particularly how tech powers productivity and enhances reach. I’m running a media company with very little Opex because of technology. I’m an SME in a highly specialised niche that can generate above average return? Am I amongst the too many businesses?

Africans need to learn to not only think for themselves, but trust their insights, conclusions and importantly instincts.

The image above speaks volumes. When the continent was being called a “Hopeless Continent”, the likes of MTN, Access Bank, Safaricom, Equity Bank, Helios and Celtel were expanding across the continent. Most of Africa’s giants were formed during this time. The Africa Rising era saw the birth of the Jumia’s and others that fell for the “increasing disposable” income story. Businesses formed during the Africa Rising story have struggled the most. Now, we’re being told that there are too many businesses. My bet is that taking the alternative view will bear fruit. If productivity is an issue, then tools that super-charge SME productivity will be valuable.

The SME Opportunity

The last couple of paragraphs can be summed up as: To succeed in Africa means understanding the nuance. There are no broad brushstrokes here. The Moniepoint Informal Economy Report highlights unemployment as a key driver of business formation, yet it also reveals that businesses lasting more than five years are often fuelled by passion. Strikingly, over 99.3% of surveyed entrepreneurs said they would return to their businesses even if offered a 20 million Naira (US$12,500) gift, over ten times Nigeria’s GDP per capita. This resilience signals a deeper truth: SMEs are not just a response to necessity but a foundation for sustainable growth.

Enabling large businesses is a worthy goal, but the immediate job to be done is increasing the probability of success for these small enterprises. Success isn’t about size alone, it’s about equipping SMEs with the tools to thrive, scale, and contribute meaningfully to the economy. Some will grow into productivity-enhancing corporations; others will remain sustainable small businesses. Either way, their success hinges on practical support, access to markets, technology, capital, and, crucially, efficient financial services. Tosin of Moniepoint captures this perfectly:

As a child, I learned to make my own toys since I didn't have any. By the time I was in university, I was helping other students and working-class people conduct research to make extra income. This was my first step into the informal economy. It was just a side hustle, so it never occurred to me to register a business and access tools that might have helped me build a practice. This ceiling is where most Nigerian businesses in our economy get stuck. - Tosin CEO of Moniepoit

The realistic take is that SMEs will remain the backbone of Africa’s economy, and their story is inseparable from the evolution of financial services. Technology, particularly in payments, is already transforming how these businesses operate, streamlining transactions, expanding reach, and unlocking new opportunities.

Payments are the lifeblood of any business, and for Africa’s SMEs, they’re a critical lever for turning resilience into growth. Efficient, accessible payment systems don’t just facilitate transactions, they unlock markets, improve cash flow, and pave the way for financial inclusion. In the next section, we’ll dive into Africa’s payments landscape to see how banking, fintech, and mobile money solutions are equipping urban bankable SMEs, like that mobile phone retailer in Lagos to thrive in a competitive world. The last decade of fintech built the foundation, payment gateways, wallets, and lending primitives. The next phase is about empowerment: delivering services that don’t just facilitate transactions but actively drive commercial success. Payments, as the lifeblood of any business, are at the heart of this shift.

This article focuses on urban bankable SMEs; businesses with formal or nearly formal structures and growth potential, like a tech enabled media company, a retail outlet in Nairobi, a mini-pharmacy in Accra or a small logistics company in Cairo. These are not the micro enterprises that operate in shacks by the road in a village. These are the SMEs poised to drive Africa’s economic future if equipped with the right tools, starting with payments.

Overview of Payments in Africa

When it comes to urban SMEs, studies by both Mastercard and Visa show that the adoption of digital payments is high. Across Nigeria, Egypt, South Africa and Kenya, digital payments adoption stands at over 90%. This growth is fuelled by a combination of traditional banking solutions, innovative fintech platforms, and the widespread use of mobile money (MoMo). In addition to these factors, necessity such as the recent cash shortages in Nigeria, Strategic benefits such as accessing wider markets due to new payment options as well as payments as a form of enhancing customer experience are all driving digital payments adoption.

This is the Fintech 1.0 wave that I mentioned earlier. I will give an overview of the SME payments landscape, focusing on banking solutions, fintech solutions, and mobile money solutions, while acknowledging the remarkable growth of digital payments.

Banking Solutions for SME Payments

Traditional banks are a cornerstone of Africa’s SME payments landscape, offering essential digital services.

Instant Bank Transfers: Nigeria’s NIBSS enables real-time payments, processing ₦600 trillion ($780 billion) in e-payment transactions in 2023.

POS Systems: Millions of POS terminals are deployed, with Nigeria having over 3 million by mid-2024, processing ₦10.73 trillion ($14 billion) in 2023.

Merchant Services: South African banks like FNB provide card payment and instant EFT services for SMEs.

These solutions are reliable in urban areas with strong banking infrastructure, often complemented by fintech and mobile money elsewhere.

Fintech Solutions for SME Payments

Payment Gateways: Paystack, Peach Payments, Ozow, Pesapal, Paymob, Fawry and Flutterwave enable seamless online payments, with Paystack processing over ₦1 trillion (US$ 625m) in July 2024.

Cross-Border Payments: Fintechs like Verto, Waza and Onafriq facilitate international payments, vital for global trade.

Value-Added Services: Tools like invoicing and payroll management enhance SME operations.

These solutions are key for tech-savvy SMEs and e-commerce businesses, offering affordable alternatives.

Mobile Money (MoMo) Solutions for SME Payments

M-Pesa in Kenya: Used by 95% of Kenyan SMEs, it facilitates over $300 billion in transactions annually.

Mobile Wallets in Nigeria and Egypt: Platforms like MTN’s MoMo and Vodafone Cash are growing, supported by initiatives like Egypt’s Meeza QR code network.

Accessibility: Extends to rural and informal SMEs, boosting financial inclusion.

Its simplicity and adoption make it a backbone of SME payments in many African countries.

The table below gives an overview of the broader payments landscape. It shows how SME payments enablement is being done across the different markets.

Gaps with Existing System

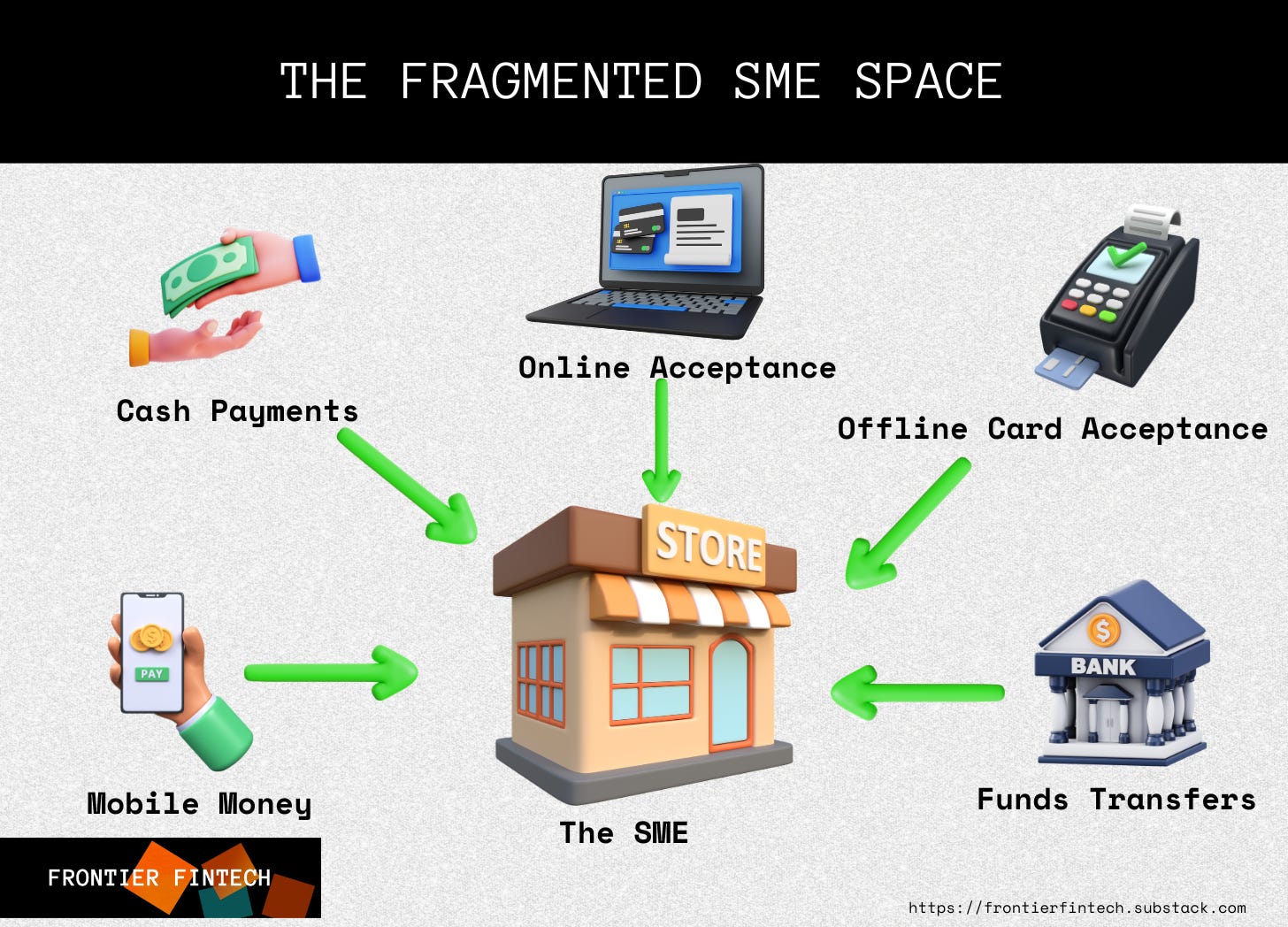

I’ve used the image above to describe the overall approach to SME payments and broadly SME financial services. Each player looks at the SME differently. PSPs focus on enabling payments, banks focus on lending, digital lenders also focus on lending, crypto players focus on stablecoin enabled cross-border payments whilst nobody or at least very few players are looking at the entire picture holistically. The outcome is often a fragmented experience for SMEs that results in sub-optimal outcomes. An example may suffice and this was from a conversation I had with Levi who’s the founder of Paycloud. In Kenya, a typical urban-retailer of electronic goods or fashion accessories has multiple payment services providers. They have Flutterwave and Paystack for online payments, Pesapal for card payments, M-Pesa for Business for mobile money payments and of course a bank account. It’s a necessity given that the more payment options they have, the better they can service different customers who may have different payment needs. The choice of service providers is based on cost and necessity. For instance, Paystack may have onboarded them ahead of Flutterwave and there’s little benefit to switching their online PSPs. For M-Pesa, it’s a necessity.

What happens is that they have a fragmented treasury situation. By Treasury, I simply mean how they manage their cash and have visibility into how money is flowing in and out of their business. The entrepreneurs build work-arounds. For instance, they may use their Paystack wallets to pay their utility bills. Use M-Pesa collections to pay staff, rent and some suppliers, whilst using their bank accounts to make larger supplier payments such as imports. Some outcomes are below;

Their bank doesn’t have a full picture on their total sales - they can’t validate this by account collections or offline visits;

Their M-Pesa has a fixed limit on their Fuliza by M-Pesa which is a business overdraft product of around US$ 3,000 - Despite doing sales of US$ 30,000 per month;

Their PSPs and Merchant Acquirer (Pesapal) are simply utilities and don’t have much visibility over their entire business - This is very different from a purely SaaS business that does all its sales online via a PSP enabled checkout option;

Ultimately, the customer experience becomes sub-optimal;

Nobody can offer them appropriate credit - Their off-line lenders don’t have the data to structure a proper facility for them and end up over-lending and over-pricing thus affecting long-term commercial success;

Fuliza is great but at a 100% APY for a low amount, it may not make sense for such a retailer. It’s great for a street vendor who has very high turnaround times and good margins, but not so good for a more established business;

Automating payment workflows becomes difficult - How do you leverage AI when data is scattered;

Very difficult to contextualise finance and make it work for the entrepreneur - how do you create financial package that makes sense e.g;

We’ll give a facility of US$ 20,000 for inventory purchases limited to x suppliers;

We’ll give a collateralised loan of US$ 15,000 for the acquisition of a car for deliveries;

We’ll recommend that the entrepreneur does Z to minimise their monthly opex due to data we’ve seen from other enterprises;

Basic payment capabilities are fixed as you can tell. As the Mastercard and Visa studies show, digital payments are happening. The challenge now is to contextualise all these digital payments to enable higher value added services to the entrepreneurs.

Winning in Payments 2.0

What’s clear is that winning in next-gen payments is not about attempting embedded lending or improving the payments experience, these are all things that existing payments players are doing. Winning will require unifying payments data and providing or enabling the provision of value added services that are downstream to this data. This approach may take many forms;

If you’re a start-up, you could just hack this by collecting all this data manually or via APIs on Google Sheets, providing visualisations to the entrepreneur through Google Data Studio or something similar and figuring out if this info can enable you to lend comfortably. The first low-risk step is by having an entrepreneur or a few entrepreneurs accept to share this data and working off-line to validate this without building anything;

If you’re a MoMo like M-Pesa, it may make sense to offer the full-suite of services by doing off-line and on-line merchant acquiring. The logic is simple, no one entrepreneur will run all payments through Lipa na M-Pesa, you may as well offer the full suite of services and get the businesses’ entire volumes. This can enable you to cross-subsidise and offer competitive pricing for card-based acquiring. You then centralise all payments into an M-Pesa wallet and the entrepreneur can decide which bank they want to do collections in.

For banks, the key is to first work on the entire payments experience. Work with players like Flutterwave and Paystack and enable automatic payouts into the bank. Whilst this may be risky, it’s something you can figure out with your partners. The idea is to incentivise your SME client to collect everything in the bank whilst ensuring you have data on all their payments. The exact mechanics can be figured out but at core is to look at payments as a data game and not a market share game. Once you change this mind-set then you can serve the SME better. The challenge with banks is that SME banking is fragmented with payments teams operating separately from commercial teams.

It may make sense for banks to build stand-alone squads that experiment on this separately from the main bank. Go to a commercial district and figure things out from scratch.

For Fintechs, it’s essentially doing what Moniepoint did. Enable payments both online and off-line with the USP being cost and reliability over UX. This gives you the first step at having proper end to end visibility over payments. Of course, the Moniepoint story is unique given the Nigerian cash shortage experience that accelerated online payments. However, these things happen when luck meets preparation. The core idea is “how much of this businesses’ payments can I see”;

For all FS players, it’s important to build connectors into SME ERPs such as Odoo and Zoho so you can unify payments data with operational data such as inventory.

Ultimately, this may mean strategic M&A across the ecosystem. Recently KCB bought Riverside which is a Payments Fintech. We may see more of this down the line. Some of the large banks in the continent need to start looking at companies like Pesapal, Paymob and others strategically as bolt-on M&As. We’ve seen this globally with Payoneer acquiring Skuad, Omnibiz acquiring Traction Apps and Deel acquiring Atlantic Money, whilst these are not banks, it’s about unifying payments and payments data.

Downstream from all these are contextual products built for the SME. It’s critical to note that if SME productivity is being driven by tech, then underlying all these tech is the idea of using technology to drive hyper-customisation. This experience needs to cut across into their financial services and this will be key in Payments 2.0. Downstream of this unification is;

Powering AI to enable higher productivity - The combination of large language models with the addition of enterprise data can be very useful. Small businesses can get services like budgeting, cash flow projections, supply chain management and high-level financial analysis. For instance, if you own a restaurant, what percentile are you in from an operating margin perspective and what can you do to improve your margins;

Contextual working capital - How can you provide responsible working capital solutions combining AI driven credit scoring with rich data? Ngozi Dozie of Carbon told me that responsible lending involves having a very clear understanding of how much a business can repay and pricing the credit responsibly. If it’s too expensive, then you attract borrowers who have no intention to pay;

Embedded payments - You can only embed payments if you know where to embed them and how to embed them. Winning in embedded payments is a data play and will require deep integration into SME ERPs;

BNPL - Whilst I’m not a big fan of BNPL at least the title BNPL because the concept has existed for decades. Nonetheless, part of the unified payments experience is enabling merchants to offer BNPL to their clients driving sales and specifically higher average order values.

Provide a comprehensive end to end solution. Both Stripe and Moniepoint offer business registration services. Stripe offers a dashboard that enables you to handle admin with regular reminders about tax-filing and various other corporate actions. Winners in SME payments will have to enable end to end corporate management. As Tosin of Moniepoint mentioned “It never occurred to me to register a business and access tools that might have helped me build a practice. This ceiling is where most Nigerian businesses in our economy get stuck.”

Conclusion

SME’s are here to stay. Whist there are too many businesses, the fact is SME-fication is a global trend that the industry needs to respond to. The Economist tends to overhype things and operating in Africa needs you to be grounded in reality. As an entrepreneur, trust your instincts and insights. The African SME story still has a long way to go. Fintech 1.0 has enabled digital payments in the SME space with M-Pesa, Flutterwave, Paystack, Paymob, Fawry. Ozow, Peach Payments and others leading the way. The Fintech 1.0 story has led to digital payment acceptance for the urban bankable SME to approach 90% across most major African countries.

This story is almost played out and the next wave of Payments will involve using payments and payments data as an enabler. The rise of AI is a multiplier to this trend enabling FIs to offer high-touch services such as budgeting, forecasting, enterprise planning and contextual working capital. Winning in Payments will be about unifying payments and leveraging data. It’s not about market share or share of volumes, it’s about seeing the forest from the trees or seeing the Elephant in its entirety. This will be done through new companies coming and solving specifically for this, M&A across existing players like is currently happening and banks taking a different approach to payments, away from volume driven KPIs.