#17 Core Banking Platforms

Evaluating the landscape under which core banking transformations are taking place and how they should be evaluated.

Hi all - This is the 17th edition of Frontier Fintech. A big thanks to my regular readers and subscribers. To those who are yet to subscribe, hit the subscribe button below and share with your colleagues and friends. 🚀

Additionally, I was featured on the Dave and Dharm Demistify podcast where we spoke about Fintech in Africa and my work in Burundi. You can find the link here. The Dave and Dharm Demistify podcast is a great podcast for the intellectually curious with a wide range of topics and concepts being discussed.

Executive Summary

The discussion this week centres on core banking systems/platforms and the decision factors facing banks in the coming years. Core banking systems have evolved over the last 50 years from first Gen mainframe based systems which were optimised for client-server architecture and high transaction throughput. Nonetheless these systems were built for branch based banking that run between 9am and 4pm. 2nd Gen systems were built on mainframes but with advancements for ATM and telephone banking. 3rd Gen systems that came up in the 90s were built on application servers with better product programmability. Nonetheless they were largely unreliable with most tier 1 banks sticking to mainframe technology.

4th Gen systems are built on cloud native principles, micro-service architecture and software as a service principles. Underpinning the change in core banking technology is a societal shift in the modes of production from standardisation and economies of scale to hyper customisation and niche production. These societal shifts will affect the nature of the provision of banking services.

The core banking ecosystem has thus evolved into four main ways. Traditional vendors are upgrading their product, composable banking has emerged, modern core providers such as Thought Machine have also emerged. Additionally, some financial service providers such as Monzo and Nubank have taken the decision to build their own cores.

Going forward, core banking decisions should move away from RFP based vendor discussions to long-term first principles based strategic thinking thus working back to your tech stack.

Thoughts around Core Banking Systems/Platforms

Discussions around core banking systems are some of the most nerve-racking discussions in the banking industry. Wrong decisions have in the past been career ending or worse, they have led to the downfall of some banks. In 2018, TSB engaged in a botched core transformation whose outcome was the corruption of over 5.4 million customer accounts. Here is a useful breakdown of what happened. Going forward, I think that the decision on core banking system transformation will be even more critical given the ever changing dynamics around technology, nature of production and the concept of financial service provision. The aim of this post is to lay out the evolution of core systems, understand the current economic landscape and evaluate the different options that banks face.

Evolution of Core Banking Systems

A core banking system is the software that enables a bank to carry out the fundamental account practices that are central to banking. These four functions are;

Ledgers - Records of the unchanging list of transactions that have been processed;

Accounts - the core account that usually maps either to a customer account or also to internal accounts such as nostro or cash accounts;

Computing balances - based on the movements in the ledgers, the core computes balances for each account;

Product engine - the capability to develop products such as savings accounts, overdrafts, term loans etc. Each product is a set of rules that impacts the computation of balances, movements in ledgers and changes in accounts;

Banks have been at the forefront of adapting technology, particularly software to power their businesses. The first generation of core banking systems were built on mainframe server technology and this evolved in the 60s. The main innovation at the time was that mainframe computers coupled with a client-server communication system enabled customers to transact in multiple branches. Prior to this, a customer could only transact in the branch in which they opened their account. Mainframes were built to handle high transactional throughput and given that banking hours were fixed, then at the end of the day, the system would run batch processes that adjusted all accounts to correspond to the transactions that were recorded on the ledgers. The need for mainframe servers was largely necessitated by the fact network technology was slow and the only way you could run multiple client sessions within your system was if you had a powerful centralised mainframe running all your transactions.

In the 70s and 80s, a 2nd generation of core banking systems emerged. Advances in alternative channels such as ATMs as well as telephone banking necessitated upgrades in the mainframe systems to handle these additional channels. The complexity of the systems increased whilst still running on mainframe servers. Mainframe systems were very reliable even at low latencies, nonetheless they were expensive to maintain given that they had to be sized for peak capacity such as end of month or end of year. The reliability is one of the reasons why some big banks still use mainframe computers up to now.

In the 1990s, a third generation emerged. They were written in more modern programming languages, relied on application servers which were cheaper than mainframe servers and had more customisable product engines. The key players in this space were the likes of Oracle, Finacle and Temenos. Despite the advances in technology, these systems still ran batch processes and were monolithic in nature. The move away from mainframe systems which were effective, coupled with growing complexity driven by an increase in third party integrations engendered less reliability in these systems. Ultimately, global tier 1 banks did not adapt these modern systems with adoption coming mostly from global tier 2 and 3 banks particularly in emerging and frontier markets.

As these systems evolved, customer demands and surrounding technologies also evolved. The 2000s witnessed an explosion of mobile banking and internet banking, whilst customers came to expect always available banking services. Banks then developed a number of workarounds;

Hollowing out the core by driving more functionality onto alternative systems such as digital banking platforms. This was done to enable the bank to offer modern propositions whilst relying less on the legacy core;

Cleverly deploying software directly into the mainframe so as to expose previously difficult to expose data via APIs;

Due to batch-based processing, banks created workarounds enabling banks to process off-line transactions at the end of the day whilst running their end of the day batch processes;

The ultimate outcomes based on all these clever workarounds can be summarised as follows;

Increased complexity and multiple interrelated points of failure. Ultimately software systems are deterministic in nature, nonetheless the complexity of these systems led to blackboxes where outcomes were unpredictable. People spoke about computer systems in words that humanised machines making them sound like moody toddlers;

Data silos - most clever workarounds revolved around building systems that interfaced with the core. You’d have a situation where both the mobile banking and internet banking platforms had customer management layers. This led to dispersed customer data and thus banks didn’t have a single view of their customers. Some banks created centralised customer management systems as a workaround to this workaround;

Increasing costs given that since these systems were monolithic, the only way you could scale was vertically i.e. by adding more server capacity. In terms of cost, you also had to pre-size your growth requirements and pay for capacity that you don’t need in advance;

Technical debt that with time slowed down your pace of innovation. This is evident in every bank. Initially you launch products and grow, but with time your pace of innovation grinds down due to the volume of technical debt that you still owe;

This has led to a new generation of core banking systems that are now characterised as 4th generation core banking systems. Ultimately, the core characteristics of these systems are;

Cloud native - built to run on cloud thus driving lower cost of ownership and easier more flexible scalability;

Micro-service architecture - Run on microservices essentially doing away with monolithic architecture where everything is tightly packed into one system. Microservices enable lateral growth.

Improvements in data and database capabilities with systems such as Kafka and New SQL databases such as Cockroach DB that enable true linear scalability as well as data streams.

API first enabling easy and intuitive integrations;

Evolution of Production

It’s critical to understand the nature of production as it pertains to the overall economy and the role that banks will have to play. The last 100 years have been the maturing of the industrial revolution that was driven by physical infrastructure such as steam engines, big oil, resource extraction and old economy technologies. The design of this economic system led to standard economic principles such as;

Mass production driven by standardisation of product, marketing and distribution. Companies like Coca Cola, Gilette and Unilever are poster boys of this framework of economic design;

Economies of scale - the idea that increased scale and efficiency leads to cost advantages. This means that as you grow bigger, you can drive cost efficiencies and thus become more competitive;

Scarcity and economics as the science behind the allocation of scarce resources;

Ultimately the name of the game was driving efficiency across a standardised product, distribution and marketing framework. This same framework applied to banking and banking software providers. Banks relied on the concept of standardising a customer and driving efficiency across this “standard” customer. Ideas such as tier 1 corporate customers or government payroll employees are de rigueur in bank strategy. Bank software providers such as Oracle, Temenos and Finacle also applied the same “standard” bank framework when designing their core systems.

Core banking decisions were then driven by;

Social proof - Bank A and Bank B are also using this core banking system;

RFP procedures were built to optimise social proof and cost;

Marginal technical differences that were largely marketing gimmicks;

Aggressive sales and marketing similar to that witnessed in consumer FMCG;

However, we are approaching a fourth industrial revolution that will change economic design and upend the economic principles of the 3rd industrial revolution.

The emergence of cyber-physical systems driven by 5G and IoT will lead to the following outcomes;

No more scale economies underpinned by increasing production. Going forward, efficiency will be driven by improved data and integration to cyber-physical systems;

No more standardisation - going forward, production and consumption will merge and future technologies will enable hyper customisation. 3D printing is already driving this;

From large companies to smaller companies - the lack of scale economies coupled with reduced transaction costs will lead to smaller niche players across industries whose focus is on improving consumer outcomes.

This is encapsulated by one of the Kings of 20th century capitalism Jorge Paolo Lehman who in 2018 stated;

I’m a terrified dinosaur, especially after attending this meeting. I went to a food panel yesterday and all they talked about was new products and new forms of producing food. Then I go to the next meeting, on artificial intelligence, and everybody is talking a lot about data analytics and things like that. I’ve been living in this cozy world of old brands, big volumes, nothing changing very much, and you could just focus on being very efficient and you’d be okay, and all of a sudden we are being disrupted in all ways. If you go to a supermarket, you see hundreds of new brands in the supermarket shelf, the client doesn’t want to leave his house anymore: he wants everything delivered to his house… In beer, we had the new kinds of beer coming in from all over [craft beer].

Companies such as Shein which has disrupted clothing retail are examples of modern day companies utilising big data, IoT and the cloud to drive improved consumer outcomes. Packy M does an amazing deep dive on Shein. Similar companies will emerge across industries.

The question for banks changes from which core banking providers should we use to how we should develop our technology platform to offer financial services in industry 4.0. Core considerations being;

From batch processing to data streams;

Cloud native technology and distributed architecture;

Embedding identity and big data with data being a new factor of production in addition to labour, land and capit

API and microservices leading to the disintermediation of the bank technology stack. A good example is that Marqeta, a card processor valued at US$ 10 billion is essentially an API between Square and Sutton Bank;

For instance, the emergence of cyber-physical systems could lead to autonomous factories. These factories will be able to perform banking services such as making payments to suppliers. To bank such a company, you’ll need to integrate to the ERP and parse their data so as to create business rules such as the overdraft limit. The ability to parse data effectively so as to offer better pricing and services will be the key differentiator. A shift away from relationship management to technology. This is not a concept that will emerge in 100 years, it’s at max three years away given that 5G is here with us.

Modern Approaches to Core Banking

There are four main approaches to core banking transformation that have emerged since the advent of modern cloud computing and big data;

Composable Banking

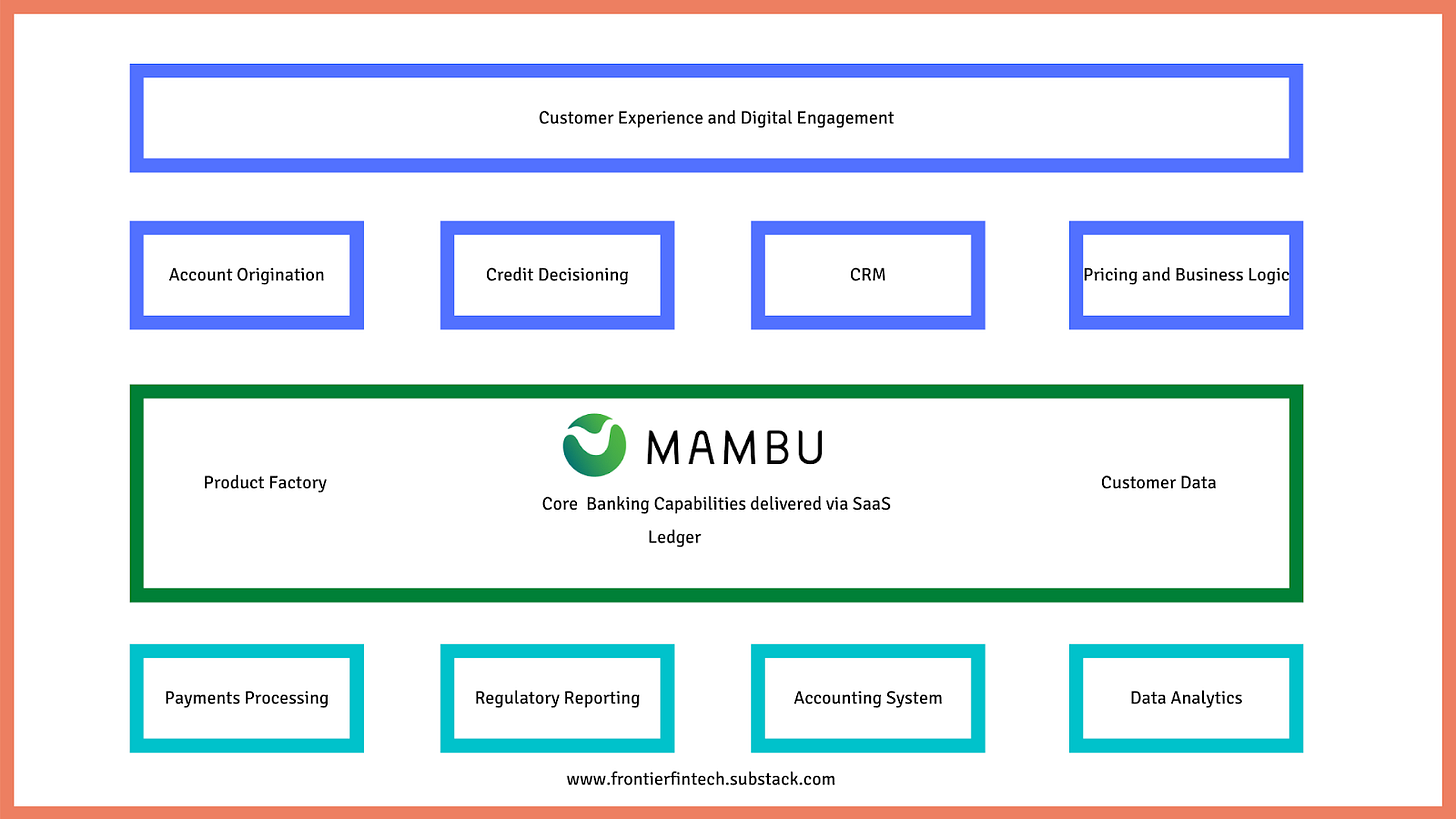

The idea behind composable banking is that due to APIs, cloud native technology and the growth of the Software as a Service business model, core banking systems can be delivered via SaaS. A leader in the composable banking framework is Mambu who have developed a core banking layer that focuses on basic customer data, ledgers and the product factory whilst providing integration connectors that enable you to integrate to best of breed providers across the technology stack. Some of these providers could be digital identity services, payment processors, CRM etc. The core idea is that technology enables you to use the best providers across different capabilities. A typical stack looks like this;

With SaaS, the economics of providing a SaaS product is that maintaining a single code base is best practice due to the costs and complexity of managing multiple code bases. The idea is thus not to customise anything in the core product. To achieve this, you then have to create standard capabilities that are required in any market. You then have to be disciplined enough to reduce the core to just its basic functionalities.

Some of Mambu’s customers include N26, OakNorth, Tyme Bank and ABN Amro’s digital proposition new10. This model is useful where you have a single customer segment you’re targeting and you have the capabilities to build the elements that add value to your business. OakNorth for instance focuses on credit decisioning for its SME lending business and thus just requires the basic ledgers from Mambu. In addition to this, your market has to have a mature set of providers across the stack e.g. identity, accounting and payments. Companies such as Backbase, Ncino and etronika provide the ancillary functions on the Mambu core.

Self Build

Some players have taken the decision to build their own core banking platforms. Some of these include Monzo, Nubank, Starling and Revolut. The idea to build could be a factor of both timing and strategy. These neobanks entered the market in the middle of the last decade around 2015 and 2016. The business model centred around payments and transaction enablement through card based payments rails whilst focusing on a world class user experience.

Scanning the market at the time, there were very few core systems that could support flexible scalability, near perfect reliability and robust payments capabilities. The existing platforms such as Temenos just weren’t built for such a business model.

In China, Webank took the same approach. Some players in the African market have taken the same approach. The similarities between Asia and Africa being that our markets are mobile-based rather than card based markets. The central logic of flexible scalability, reliability and high transaction throughput nonetheless is the core logic of a self-build. For those who want to jump into technical rabbit holes. These three resources are a gold mine in understanding the technical considerations for Monzo, Nubank and Starling Bank.

Of course one of the downsides of this is the increasing complexity of building a core platform from a technical resource perspective. It could be difficult to do this in Africa. A workaround could be contracting a software company to build and maintain your system. Some argue that the core banking system will be the dumb part of your stack and thus there’s no point in building it.

Traditional Vendors;

Traditional vendors such as Oracle Flexcube, Finacle, Temenos and Fiserv have upgraded their core platforms to be cloud native whilst offering their usual rich product factories. Ultimately, these traditional players have significant resources compared to the new players whilst having deep relationships with their bank clients.

The technical designs often involve the basic ledgers, product factories, accounts and customer data systems. In addition, these providers offer payment systems, wealth management, treasury capabilities and nowadays API marketplaces that offer partner services. An example is Finastra’s fusion store API marketplace. In terms of capabilities, the modern offerings from the traditional players are very rich and capable. Nonetheless some concerns emerge;

Still built for “standard” bank which may be a dying concept;

Building for on-prem, cloud native and cloud enabled deployments leads to a situation in which they are not optimised for any deployment;

Some neobanks have adopted core bankings from the traditional players. UK Neobank Gravity has partnered with Finastra whilst Temenos counts Next Commercial Bank of Taiwan as well as Australian Neobank Volt. The idea here is that there’s a separation between the digital banking platform i.e. where the bank creates value and the grunt work of managing ledgers and products.

An interesting development within the traditional model is the entry of players such as Huawei who integrate an advanced payments platform built for high transaction throughput onto their hyperconvergence architecture. This then is integrated to a core banking vendor of your choice so as to ensure that the system can scale whilst maintaining the stable elements of the core. This is a concept of having a dual core best articulated here.

New Generation Core Providers;

From around 2017 onwards, a new generation of core banking providers has emerged to take advantage of concepts such as open banking, cloud computing, banking as a service and the componetisation of financial services. These providers have the following key factors in common;

Micro-service architecture with a service mesh;

Built for data streaming often using Apache Kafka;

Purely cloud native;

Often a SaaS business model;

In addition to the above, unlike Mambu, these players have a richer product set that includes treasury, payments, corporate banking, Platform as a Service and wealth capabilities in-built as part of the core proposition. Some of the key players are Thought Machine, 10x and Vodeno.

The main advantages are the scalability, security, low cost and high availability that arise from pure cloud systems. Nonetheless, these players are yet to be stressed tested over multiple deployments, markets and economic cycles like their more traditional players.

Summing it all Up;

Approaching core transformation should be approached differently as compared to the past. More onus shift towards the ownership of the bank as regards to articulating a clear vision of how the bank plans to operate in the future and then work backwards to define what kind of technology platform you will require. A more first principles approach to technology vis-a-vis anchoring based on traditional best practices.

Additionally for African banks, the discussion should be centred around core factors such as driving financial inclusion, closing the SME funding gap, catering to micro-entrepreneurship and the creator economy as well as modern financing techniques for industry 4.0. The lexicon around banking and technology has been dominated by western concepts such as “delightful customer experiences” which are important but not critical. I think Africans need deeper issues solved such as accessibility, pricing and appropriateness. I would venture to say that a functional product with a crappy UX in Africa will do better than the most “delightful” app.

It will get more and more difficult and management that has been trained to be efficient and process based will struggle. A new leadership that focuses on a principle based approach to thinking about the business is better suited to make such decisions. Additionally, it may make more sense for African banks to turn towards China given the ubiquity of mobile payments in both markets bar South Africa.

As always thanks for reading and drop the comments below and let’s drive this conversation.

If you want a more detailed conversation on the above, kindly get in touch on samora.kariuki@gmail.com;